Chinese foreign direct investment in the EU 2019: Lower investment, deeper entanglement and new concerns

New Report by Rhodium Group and MERICS

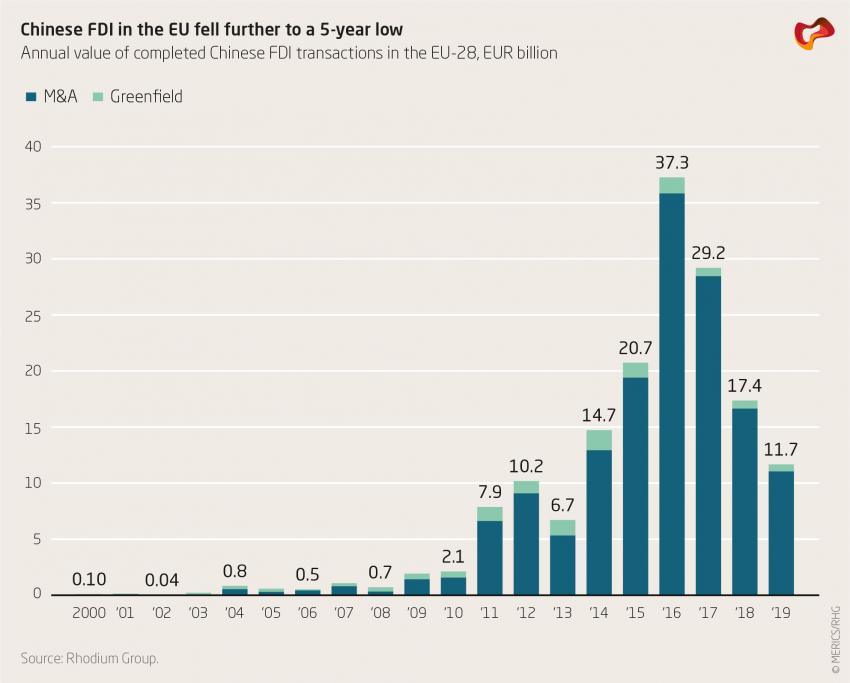

Chinese foreign direct investment (FDI) in the European Union (EU) continued to decline in 2019, mirroring the decline in Chinese investments globally. Along with a shift in geographical distribution, preferred sectors changed, with consumer products and services overtaking automotive as the main target for Chinese investors.

While equity investment has fallen, research and development collaborations between Chinese and foreign firms, universities and governments have continued to grow. Although the majority are benign and desirable from a European perspective, some raise concerns that must be addressed.

These are the key findings of the joint report of Rhodium Group and MERICS “Chinese FDI in Europe: 2019 Update” by Agatha Kratz, Mikko Huotari, Thilo Hanemann and Rebecca Arcesati, that was released today.

Fall in Chinese FDI in Europe

In 2019, Chinese firms completed FDI transactions worth EUR 12 billion, a decline of 33 percent from 2018 levels, bringing the total back to 2013 levels. This was due mainly to continuing capital controls, a clampdown on the “irrational” acquisitions of a few key investors and a deleveraging campaign that reduced Chinese firms’ ability to finance overseas assets purchases. The decline is in line with the downward trajectory of China’s global outbound investment since 2016.

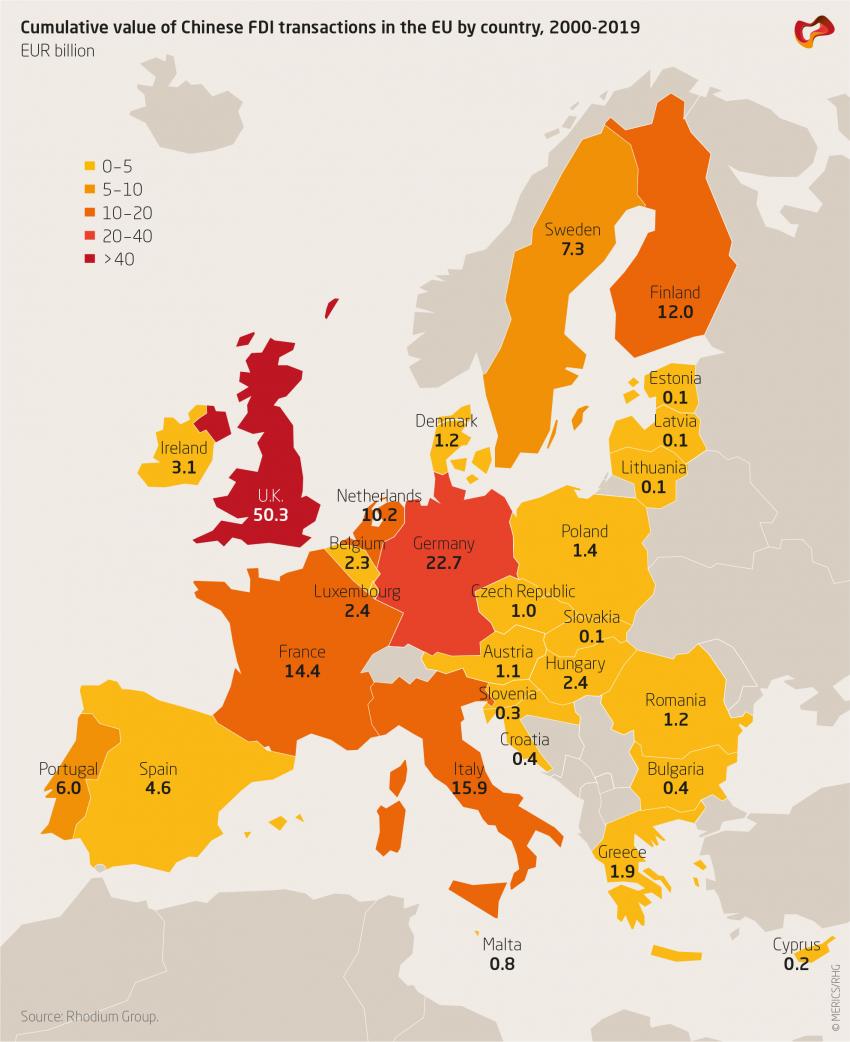

The geographic distribution of Chinese investment in the EU shifted last year noticeably. For the first time since 2010, Northern Europe was the top recipient of Chinese capital, receiving 53 percent of all Chinese investment, and overtaking the “Big 3” (UK, Germany and France). The UK remained the second largest recipient of Chinese FDI within the EU by volume in 2019 and topped the list for the number of individual transactions. Eastern Europe’s weight increased slightly from 2 percent in 2018 to 3 percent in 2019, and the shares of Southern Europe and Benelux both decreased to under 10 percent.

The industry mix is shifting toward consumer products and services; ICT remains strong

Consumer products and services were the main target for Chinese investors in 2019, overtaking automotive and accounting for 40 percent of investment volume. The shift was due to a single mega deal: Anta bought Finnish sporting goods group Amer for EUR 4.6 billion, one of the largest Chinese investment in Europe of the past 20 years.

ICT remained a top sector in 2019, making up 20 percent of all individual transactions, and coming second in terms of volume at EUR 2.4 billion. Chinese firms continue to be interested in European technology, companies and know-how. Automotive followed in third place with EUR 1.3 billion worth of investment.

The share of state-owned investors plummeted

The proportion of inbound investment from China’s state-owned enterprises (SOEs) fell further to just 11 percent of aggregate investment. Continued administrative controls and financial constraints in China and a changing regulatory environment in Europe contributed to the drop. But SOEs’ decreased share also reflected the weight of significant acquisitions by private players.

Outlook for 2020

The authors of the report argue that the global Covid-19 pandemic will deeply impact global capital flows, including China’s outbound investment. The shutdown of large parts of China’s economy in February and March has already had a negative effect on Chinese deal-making in the first three months of 2020. Early data points indicate that the first quarter of 2020 will show the lowest outbound deal volume from China in almost ten years.

Yet the crisis is also creating buying opportunities in Europe and elsewhere. Past crises saw Chinese firms acquire discounted assets around the globe. However, an opportunistic Chinese buying spree in the wake of the Covid-19 crisis is less likely today, given increased public scrutiny and tools to screen investment in recipient countries. The authors expect Chinese outbound investment to increase during the remainder of the year from a very low base, but a return to boom levels of 2015-2016 levels is unlikely.

Chinese firms are looking for alternative ways to interact with European entities

As acquisitions and other equity investment have become more difficult, Chinese firms are pursuing alternative ways to interact with European entities. Chinese companies have stepped up research and development (R&D) collaborations with EU companies, universities and governments, among other channels. Though most of these partnerships are benign and desirable from a European perspective, some raise important concerns. Problematic cases exist, including those that facilitate the transfer of critical and dual-use technologies to China´s military-industrial complex or contribute to the state’s ability to exert mass control over its population.

Europe needs to get better at identifying problematic tie-ups

As with investment screening, EU leaders need to find solutions that address specific concerns while preserving Europe’s economic openness. The authors argue that scrutiny should be expanded to cover R&D collaborations. Failure to act will invite pushback from key allies and OECD partners, risking costly and unnecessary decoupling. Researchers, whether at companies or universities must understand China’s firms and policies better, to identify and mitigate against risks. Addressing these challenges, MERICS and Rhodium Group give initial recommendations on how to respond.

You can read the full report “Chinese FDI in Europe: 2019 Update, Special Topic: Research Collaborations” online here.

Media Contact

The experts of the Mercator Institute for China Studies are available to comment on current news, as panelists or as op-ed authors.